Whether you’re planning for a business expansion, financing a piece of equipment, or managing current debt, this tool provides clarity. It calculates the fixed monthly payment you can expect and the total interest you will pay over the full life of the loan. Use this tool to compare loan offers, budget accurately, and make the best financing decision for your business.

Simple Loan Repayment Calculator

Estimate your monthly payment and total interest paid.

Results:

Monthly Payment ($): 0.00

Total Interest Paid ($): 0.00

Short Instructions

To use the calculator, simply provide three inputs:

- Loan Principal ($): The initial amount of money you plan to borrow.

- Annual Interest Rate (%): The stated yearly interest rate for the loan (e.g., enter 5.5 for 5.5%).

- Loan Term (Years): The length of time (in years) you have to pay back the loan.

Click ‘Calculate Payment’ to receive your Monthly Payment amount and the Total Interest Paid over the term.

How This is Helpful for Business

Accurately forecasting loan payments is essential for cash flow management and long-term planning:

- Budgeting Certainty: Loans typically require fixed monthly payments (amortization), which this calculator provides, allowing you to accurately incorporate the expense into your monthly operating budget.

- Total Cost Awareness: The calculator highlights the Total Interest Paid, revealing the true cost of the loan beyond just the principal amount. This helps in assessing the overall impact on profitability.

- Scenario Planning: By adjusting the Loan Term and Annual Interest Rate, you can quickly compare different borrowing scenarios (e.g., shorter term vs. lower rate) to find the most financially sound option.

- Debt Management: It’s foundational for developing a clear repayment strategy and maintaining a healthy debt-to-equity balance.

What Actually This is Based On

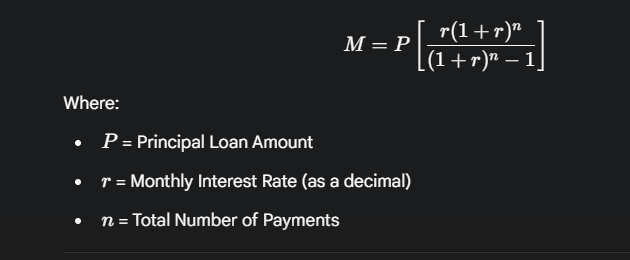

The calculator uses the standard Amortization Formula, which is designed to determine the equal periodic payments required to pay off both the principal and the interest on a loan over a set period.

The calculation requires two key conversions:

- Periodic Rate ($r$): The annual rate is divided by the number of payments per year (12 for monthly payments).

- Total Periods ($n$): The loan term in years is multiplied by the number of payments per year (12).

The formula used to find the Monthly Payment (M) is: