The Future Value of an Annuity Calculator—the key tool for long-term financial planning and visualizing the power of compounding.This calculator shows you exactly how much a series of regular, equal payments will be worth at a specific date in the future, assuming a constant interest rate. Whether you’re planning for retirement, saving for your child’s education, or building a capital reserve, this tool quantifies the potential growth of your disciplined savings habit. See the future result of your consistent investment strategy today.

Future Value of an Annuity Calculator

Calculate the future value of a series of regular payments.

Results:

Total Investment Value ($): 0.00

Short Instructions

To use the calculator, provide four pieces of information about your investment:

- Periodic Payment ($): The exact dollar amount you will contribute at regular intervals (e.g., 1$\$ 500$ per month).2

- Annual Interest Rate (%): The stated yearly interest rate the annuity earns.

- Investment Term (Years): The total number of years you plan to make payments.

- Payments/Compounding Frequency: How often the payment is made and interest is compounded (e.g., Monthly, Quarterly, Annually).

Click ‘Calculate Future Value’ to receive the Total Investment Value at the end of the term.

How This is Helpful for Business

The Future Value of an Annuity is essential for any long-term financial strategy, both personal and corporate:

- Retirement Planning: It’s the standard method for determining if current retirement contributions (e.g., 401k or pension plans) will be sufficient to meet future income goals.

- Sinking Fund Analysis: Businesses use this to calculate the necessary periodic payments into a sinking fund to accumulate a specific amount of cash by a future date (e.g., to replace equipment or pay off a large bond).3

- Comparative Analysis: It helps compare different investment options.4 For example, you can see how much more you’ll accumulate by increasing your payment frequency from annual to monthly, even if the total amount contributed remains the same.

- Debt Management: It can be used in reverse to determine the amount needed to save periodically to pay off a known future liability.

What Actually This is Based On

The calculation uses the Time Value of Money principle, which states that money available now is worth more than the same amount in the future due to its potential earning capacity.5 The formula aggregates the future value of every single payment made into the annuity.

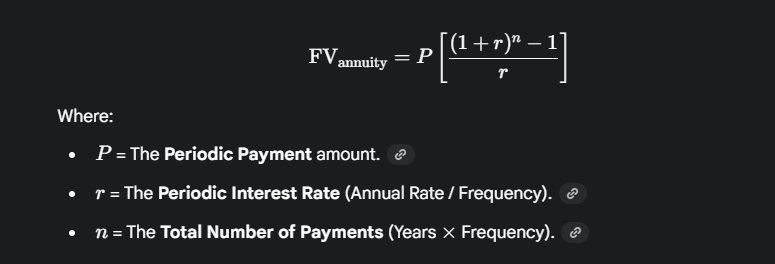

The formula for the Future Value of an Ordinary Annuity (payments made at the end of the period) is:

Example: If you deposit $\$ 1,000$ every year for 10 years at a $5\%$ annual interest rate, the future value calculation accounts for the compounding interest earned on the initial payments over a much longer time than the payments made near the end.