Welcome to the Days Sales Outstanding (DSO) Calculator—the crucial metric for tracking your business’s cash flow efficiency.

DSO measures the average number of days it takes for your company to collect payment after making a sale on credit. A low DSO is a strong indicator of efficient collections and robust cash flow, while a high DSO suggests customers are paying slowly, tying up working capital and potentially increasing the risk of bad debt. Use this calculator to benchmark your collection performance and tighten up your accounts receivable process.

Days Sales Outstanding (DSO) Calculator

Calculate the average number of days it takes to collect revenue.

Results:

Days Sales Outstanding (DSO): 0.00 days

Short Instructions

To use the calculator, provide three inputs for a specific period (e.g., the last quarter or the full year):

- Average Accounts Receivable ($): The average amount customers owe you during the period.

- Total Credit Sales ($) (for period): The total revenue generated specifically from credit sales (excluding cash sales).

- Number of Days in Period: The number of days being analyzed (e.g., 90 for a quarter, or 365 for a year).

Click ‘Calculate DSO’ to receive the average number of Days Sales Outstanding.

How This is Helpful for Business

DSO is a primary driver of a company’s working capital cycle, making it invaluable for management:

- Cash Flow Optimization: Since sales aren’t complete until the cash is collected, a lower DSO means cash hits your bank account faster, reducing the need for short-term borrowing.

- Collection Effectiveness: DSO serves as a direct measure of how well your internal credit and collections team is performing. Significant increases in the number indicate problems with invoicing or follow-up.

- Credit Policy Review: If your DSO consistently exceeds the payment terms you offer (e.g., 30 days), it’s a clear signal that your credit policies are too lenient or need stricter enforcement.

- Bad Debt Risk: High DSO figures often correlate with a higher risk of non-collection, as older receivables are less likely to be paid.

What Actually This is Based On

The Days Sales Outstanding (DSO) is calculated by comparing the current amount of money owed by customers (Accounts Receivable) against the rate at which sales are generated (Credit Sales), projected over the number of days in the period.

The calculation is typically performed in two steps:

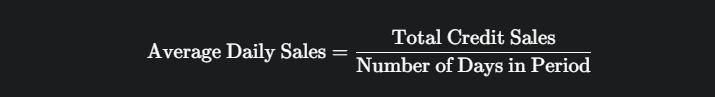

1. Average Daily Sales Calculation

This is the amount of revenue generated each day during the period.

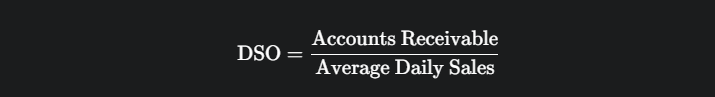

2. Days Sales Outstanding (DSO) Calculation

The final DSO is the Accounts Receivable divided by the Average Daily Sales:

Interpretation: If your DSO is 45 days, it means on average, your customers are taking 45 days to pay you. If your standard credit term is Net 30, a 45-day DSO suggests slow collections.