The Break-Even Point is the crucial line in the sand where your total revenue exactly equals your total costs. By knowing this number, you can set realistic sales targets, make informed pricing decisions, and confidently manage your operational expenses. Use this calculator to define your minimum viable sales volume and move past the point of loss.

Break-Even Point Calculator

Find the minimum units you need to sell to cover all expenses.

Results:

Contribution Margin per Unit ($): 0.00

Break-Even Point (Units): 0

Short Instruction:

To use the calculator, you will need to input three critical financial figures:

- Total Fixed Costs ($): Expenses that do not change regardless of production volume (e.g., rent, insurance, loan payments).

- Selling Price per Unit ($): The amount of money you charge customers for one unit of your product or service.

- Variable Cost per Unit ($): The direct cost associated with producing or acquiring one unit (e.g., raw materials, direct labor).

Click ‘Calculate Break-Even’ to instantly determine the Break-Even Point in Units and the foundational metric: the Contribution Margin per Unit.

How This is Helpful for Business

Determining the Break-Even Point is a cornerstone of sound financial planning and strategy. It offers powerful insights:

- Risk Assessment: It identifies the minimum sales volume required to avoid losses, making it easier to gauge the financial risk of a new project.

- Target Setting: It provides a clear, actionable sales target for your team. Every unit sold after the break-even point contributes directly to profit.

- Pricing Decisions: It helps you understand if your current pricing strategy (Price minus Variable Cost) is high enough to cover your Fixed Costs efficiently.

- Cost Management: If the required break-even volume is too high, it provides immediate evidence that you must either reduce your Fixed Costs or your Variable Costs.

What Actually This is Based On

The Break-Even Point analysis relies on the principle that total revenue must cover two cost components: Variable Costs and Fixed Costs.

1. Contribution Margin (CM) Calculation

First, we find the profit made on each individual unit after covering its direct production cost:

$$\text{Contribution Margin} = \text{Selling Price per Unit} – \text{Variable Cost per Unit}$$

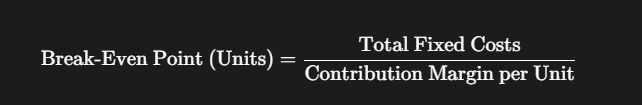

2. Break-Even Point (BEP) Calculation

Next, the Total Fixed Costs are divided by the Contribution Margin to find how many units must be sold to “contribute” enough cash to cover those fixed expenses.

The result is always rounded up to the nearest whole unit, as you cannot sell a fraction of a product to cover your costs.