Welcome to the Compound Annual Growth Rate (CAGR) Calculator—the most accurate measure of sustained, long-term business and investment performance.

Unlike simple annual return, CAGR smoothes out the volatility and fluctuations inherent in real-world performance to show you what your annual growth rate would have been if the growth were steady (compounded) over the entire investment period. This is the standard metric used by investors and analysts to compare the performance of different companies, markets, or strategies over multiple years.

Compound Annual Growth Rate (CAGR) Calculator

Calculate the smooth, average growth rate of an investment.

Results:

Compound Annual Growth Rate (CAGR): 0.00%

Short Instructions

To use the calculator, you need three pieces of data:

- Beginning Investment Value ($): The initial value of the investment, project, or revenue stream at the start date.

- Ending Investment Value ($): The final value after the measurement period is over.

- Number of Years (Term): The length of the investment period in years (must be greater than 1).

Click ‘Calculate CAGR’ to receive the annualized percentage rate that shows the average growth of your investment over the term.

How This is Helpful for Business

CAGR is invaluable for strategic planning and reporting because it provides a realistic, normalized view of growth:

- True Performance Comparison: Since it annualizes returns, it allows for a direct, apples-to-apples comparison between investments that have very different lifespans (e.g., comparing a 3-year investment to a 10-year investment).

- Forecasting and Planning: It provides a reliable historical growth rate that can be used as the basis for projecting future revenues, profits, or market share under stable conditions.

- Smoothing Volatility: Real growth is often choppy (high one year, low the next). CAGR removes this “noise” to present a single, manageable number that represents the underlying trend.

- Investor Reporting: It is the primary growth metric requested by investors, as it provides a clear indication of a business’s capacity for sustained expansion.

What Actually This is Based On

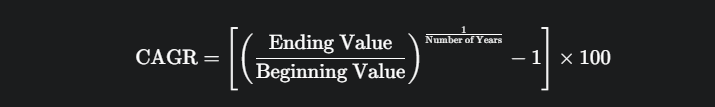

CAGR uses the principle of geometric progression to calculate a constant rate of return that would be required for an investment to grow from its beginning value to its ending value over the specified number of years, assuming the profits were reinvested (compounded) each year.

The mathematical formula is:

Example: If revenue grew from $\$ 100,000$ to $\$ 150,000$ over 5 years, the CAGR is calculated, and the result is a percentage that can be directly applied to any annual projection.