Welcome to the Working Capital Calculator—the quickest way to measure your company’s short-term financial health and operational liquidity.

Working capital is the lifeline of daily business operations. It represents the money you have available to cover immediate expenses, pay bills, and fund short-term needs. A healthy amount of working capital means you can operate smoothly without stressing over cash flow, while a deficit signals potential risk. Use this tool to instantly calculate your Net Working Capital and the critical Current Ratio.

Working Capital Calculator

Determine your short-term liquidity and financial health.

Results:

Net Working Capital ($): 0.00

Current Ratio: 0.00

Short Instructions

To use the calculator, you need two fundamental inputs from your balance sheet:

- Total Current Assets ($): The sum of all assets expected to be converted to cash within one year (e.g., cash, accounts receivable, inventory).

- Total Current Liabilities ($): The sum of all debts and obligations due within one year (e.g., accounts payable, short-term debt).

Click ‘Calculate Working Capital’ to receive both the dollar amount of your Net Working Capital and your Current Ratio.

How This is Helpful for Business

Working capital analysis is crucial for managing day-to-day operations and making timely decisions:

- Liquidity Check: It immediately shows whether your business has enough liquid assets to meet its short-term financial obligations. A positive working capital is usually a necessity for survival.

- Operational Efficiency: It indicates how effectively management is using current assets. Too much inventory or too many slow-to-collect accounts receivable can needlessly tie up valuable capital.

- Lender Confidence: Banks and creditors often review the Current Ratio (Current Assets / Current Liabilities) to determine a company’s ability to service its debt. A ratio around $1.5$ to $2.0$ is often considered healthy.

- Expansion Planning: Knowing your working capital ensures that any planned expansion or investment won’t deplete the cash needed for necessary daily expenses like payroll and utility bills.

What Actually This is Based On

The calculator determines a company’s financial cushion using two straightforward formulas:

1. Net Working Capital Calculation

This is the simple difference between what the business owns short-term and what it owes short-term. The result is a dollar figure.

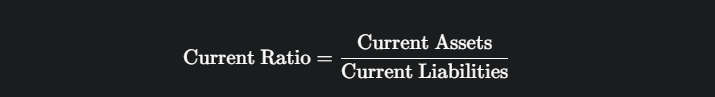

2. Current Ratio Calculation

This is a more telling measure of liquidity, expressing the working capital relationship as a ratio.

Interpretation: A Current Ratio of $2.0$ means the company has twice the amount of short-term assets as it has short-term debt, indicating a strong liquidity position.