Welcome to the Effective Interest Rate (EIR) Calculator—the key to understanding the true cost of borrowing or the real yield of an investment.

The Nominal Rate (the advertised rate) often ignores the effect of compounding—how frequently interest is calculated and added back to the principal. The EIR, sometimes called the Annual Percentage Yield (APY), reveals the actual rate you pay or earn over a year. Use this calculator to compare offers with different compounding frequencies (e.g., a loan compounded monthly versus one compounded quarterly) and make a truly informed financial choice.

Effective Interest Rate (EIR) Calculator

Find the true annual rate after accounting for compounding.

Results:

Effective Annual Rate (EIR): 0.00%

The true annual interest rate applied.

Short Instructions

To use the calculator, simply provide two inputs:

- Nominal Annual Rate (%): The stated, yearly interest rate (e.g., enter 6.0 for 6%).

- Compounding Frequency: Select how often the interest is calculated and applied within a year (e.g., Monthly, Quarterly, Annually).

Click ‘Calculate EIR’ to receive the Effective Annual Rate (EIR) expressed as a precise percentage.

How This is Helpful for Business

Ignoring the effects of compounding can lead to significant financial miscalculations. The EIR is essential because:

- Accurate Cost Analysis: For loans, a high compounding frequency (e.g., daily) means you pay more interest overall than the nominal rate suggests. The EIR gives you the actual annual cost.

- Investment Comparison: When comparing investment vehicles (like savings accounts or bonds), the one with the highest EIR (or APY) is the better choice, even if the nominal rates appear similar.

- Due Diligence: It allows you to look past marketing claims and understand the legal reality of the financial agreement, ensuring you meet regulatory requirements that often mandate disclosing the effective rate.

- Budgeting Precision: Knowing the true annual rate allows for more accurate long-term financial forecasting and capital expenditure planning.

What Actually This is Based On

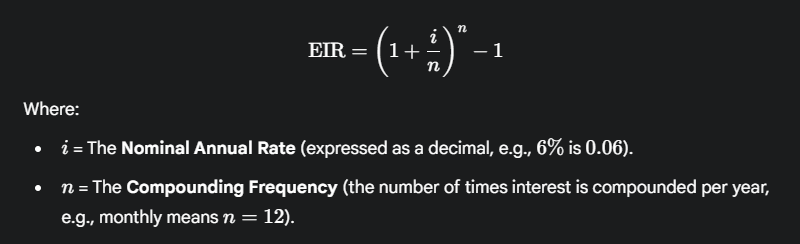

The Effective Interest Rate is calculated by determining the total growth of the principal over one year due to the effects of compounding.

The calculation uses the following formula:

Example: A nominal rate of $5\%$ compounded quarterly ($n=4$) results in an EIR of approximately $5.0945\%$. This means your $5\%$ loan actually costs you $5.0945\%$ annually.